A REVERSE MORTGAGE MAY LET YOU

stay in your home

and fund the important things

If you or your spouse is age 62 or older, you may be eligible for a reverse mortgage that can convert your home from a cash flow vacuum cleaner into a cash flow fan as you arrange for a more comfortable retirement!

What Is A Reverse Mortgage?

Reverse Mortgages enable eligible home owners access to money they have built up as equity in their homes. They are primarily designed to strengthen seniors' personal and financial independence by providing them with the funds they need to stay in their homes without the burden of monthly mortgage payments as long as home owner pays the property taxes, insurance and maintains the home.

The major reverse mortgage

eligibility requirements are that applicant(s) must be at least 62 years of age or older, own and occupy a home whose mortgage has been paid in full, or with a relatively low mortgage balance remaining in comparison to the value of the home.

How a Reverse Mortgage

Revamped Martie Miller's Finances

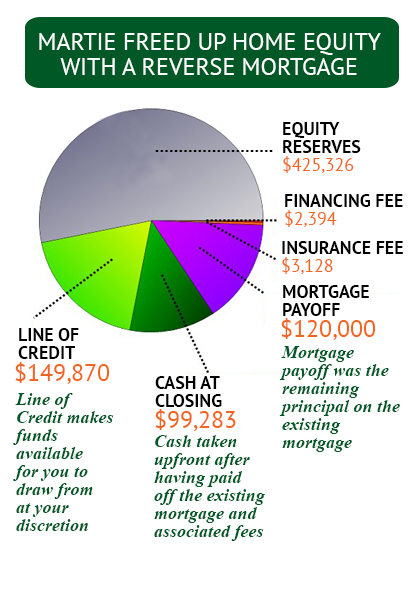

Now that you have the basic information about reverse mortgages, let’s take a hypothetical case.

Martie Miller is

entering her later retirement years and has

built up considerable equity in her home.

Here are her wishes:

- She wants to stay in it. After all, she likes

it and she’s comfortable there. A senior

living facility is just not for her.

- Her home does need some repairs plus

she plans on doing some bathroom

remodeling to make her shower areas safer.

- She would like to have some cash now so she

can pay off her credit cards and still have

enough left over to meet

her daily needs for some time to come.

With a Reverse Mortgage, Martie's Wishes Come True...

Cash at closing: ~$100K

Line of Credit: ~$150K

No Monthly Mortgage

Stay in Her Home as Long As she Likes...

The above chart shows how a reverse mortgage can empower someone like Martie to secure her golden years. This is just an example and that similar results are not guaranteed. To find out how a reverse mortgage can help you,

contact mortgage loan originator John Alma Hanson for a free quote.

Why Reverse Mortgages are More Senior-Friendly

than Home Equity Loans

Reverse mortgages and home equity loans both use your property as collateral; however, the two differ fundamentally.

With a home equity loan, when repayment of the loan is in jeopardy due to a loss of income, the borrower(s) can be forced to sell or vacate their home. On the other hand, with a reverse mortgage, the lender gets repaid when the home is sold or is no longer used as the owner's primary residence.

|

HOME EQUITY LOAN |

REVERSE MORTGAGE |

| Uses Property As Collateral |

Yes |

Yes |

| Repayment to Bank |

Monthly |

Deferred* |

| Your Access to Funds |

As Long As Your Payments Are Current |

As Long As You Live In Your Home |

| FHA Insured |

No |

Yes** |

* No payment is required during owner's life time as long as home owner does not default. Home owner is responsible for property taxes, insurance and maintain the home.

Contact mortgage loan originator John Alma Hanson to find out how a reverse mortgage could work for your situation.

** Borrower pays for the premiums for the insurance.

Equity Protection:

Reverse Mortgage Vs. Equity Loan

The equity in your home is what makes it possible to enjoy the benefits of liquidity that a reverse

mortgage offers. Even as you finance the next stage of your retirement, you still want there to be

a considerable amount of equity in your home so you can enjoy other options later in life or leave

assets of substantial value to your heirs.

|

HOME EQUITY LOAN |

REVERSE MORTGAGE |

| Maximum Loan Amount |

Up to 80% of Home Value |

Based on Your Age and Property's Value** |

| Main Criteria to Qualify |

Ability to Repay From Income |

Ability to Repay at Sale or Refinancing |

Regulated and Guaranteed by the

US Government for Safety and Security

Reverse Mortgages are fully insured by the Federal Housing Administration (FHA). The Department of Housing and Urban Development (HUD) participate in regulating this unique loan program and the home mortgage industry as a whole.

FHA has been the nation’s largest source for reverse mortgages since 1989. Their protection guarantees that no debt can go against other assets in your estate, or even be passed to your heirs.

You continue to own your home and can still leave it to your children or their heirs as long as you continue to pay property taxes, insurance and maintain the home. If you live in your home until you pass on, your heirs will have the choice to either pay the Reverse Mortgage balance and keep the home or sell the home and keep the remaining equity.